Do your thing,

Stay on top of things with Germany's most modern tax consulting for the self-employed. Our team of tax experts and utilization of the Kontist App will simplify your life.

Simply click the activation button and get in touch with us today.

Leave the tax authorities to us - we represent you in your interest.

We receive your mail from the tax office and handle communication with the relevant authorities as needed.

We'll only contact you when you need to take action.

If you wish, we can translate the bureaucratic German into a language easy to understand.

Simplify your bookkeeping - have more time for what really matters.

Professionals are taking care of your bookkeeping.

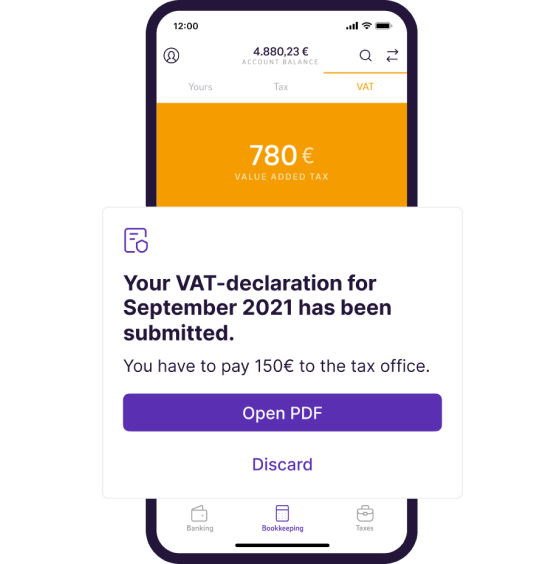

Timely filing of your VAT returns is our top priority.

Maintain control over your submitted paperwork, all in one digital hub.

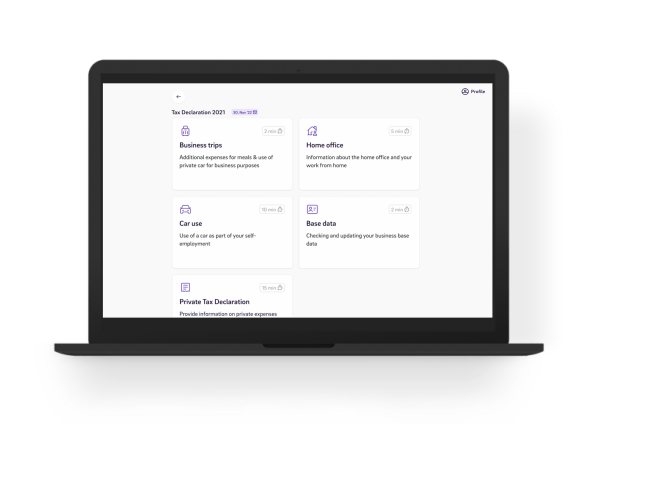

Tax returns made easy – digital, reliable and on-time

Accurate Profit & Loss Statement (EÜR), income tax, VAT, and trade tax declarations.

Easily submit information and documents through your Kontist Spp.

Your tax declarations will be handled by our tax experts and submitted on schedule.

All of your expenditures are considered by us.

Get peace of mind in all things taxes - our tax experts understand your needs.

Tax advisors specializing in solo self-employment.

Access to professional tax advice. More information in the FAQs.

Together we optimize your tax matters.

Receive a comprehensive check of your tax situation during our mandatory first meeting with experts.

Thousands of self-employed people rely on Kontist Steuerberatung.

The best thing about Kontist is that I can see immediately how much is left for me and how much goes to the tax office. This saves me from nasty surprises when it comes to my tax return.

I feel like I am in good hands here and I can wholeheartedly recommend Kontist.

I came to know you through your YouTube videos and I am thrilled with how personable and competent you are in imparting your tax knowledge. I celebrate you!

cool app with great, simple functions! everything became completely clear to me! with pre-tax payments i have no more problems! i can recommend the kontist app to freelancers without any hesitation!

Kontist makes taxes easy. I am thrilled. I can recommend it 100% for IT freelancers.

I can allocate all incoming payments easily and quickly, and the app calculates the tax amounts right away. I love the fact that I no longer have to spend hours trying to figure out my taxes! Very handy app!

Thousands of self-employed people rely on Kontist Steuerberatung.

Frequently Asked Questions. Happy to answer.

Who can use the Tax Service?

As of now, the Kontist Tax Service is exclusively available to self-employed freelancers, sole proprietors, or business owners. (Not open to companies such as AG, GbR, GmbH, KG, Ltd., OHG, or UG).

In addition, the following guidelines currently apply:

- no cash receipts

- no activity involving the sale and shipment of physical goods

- no multiple self-employment (multiple tax numbers or multiple EÜRs required)

- no balance sheet accounting

- no tax avoidance schemes

We also reserve the right to exclude certain professions or industries from the Kontist Tax Service for internal administrative reasons. These include craftsmen, cleaning staff, artists, and restaurateurs.

Is the Kontist business account mandatory?

The Kontist Tax Service is only available to self-employed Kontist Premium customers who use Kontist as their primary business account. If you do not have a Kontist Premium Account yet, the upgrade to Premium is included in the price.

How does the Tax Service work?

Our Tax Service assists you in fulfilling your tax responsibilities and takes on some tasks on your behalf or enables you to complete them. However, your cooperation is essential in this process.

To ensure a smooth process, it is imperative that you actively use your Kontist Account as a business account. Most importantly, we require accurate documentation for each transaction.

You have various options to submit your receipts to us. You can find more information .

We primarily communicate with you via email, so please keep an eye on our messages in your inbox.

Which services are included?

Our provides a comprehensive breakdown of the services covered by your flat rate.

Additional services can be booked at unit prices or are charged at half-hourly rates. By properly preparing for extra consultation hours using our YouTube videos or Help center, you can potentially reduce the time required.

What does "communication with the tax authorities" mean?

At the beginning of your mandate, you will sign a power of attorney in your Kontist App. We will then submit this to your responsible tax office, which means that we will represent you in communication with the tax office.

The tax office will therefore contact us if there is anything to discuss. If we require your cooperation, we will contact you with the next possible steps.

What's included in the tax consulting?

The tax consulting included in your flat rate price covers the following topics: home office, deductibility of travel expenses, taxation of company cars, invoicing, fixed assets & depreciation.

Other tax consulting topics are an additional fee-based service. Our pool of experienced tax consultants is available to you for this purpose.

. The billing is done in half-hourly increments.

What is the notice period?

You can submit your written notice of termination via chat or email. Payment of the entire annual fee is the essential requirement for the preparation of your tax returns. Therefore, the termination must be submitted at the end of each year.

Your data will be collected throughout the year.